06 Jan NRI Real Estate Investment in India: Why It’s More Than Just an Emotional Connection

NRI Investment in India: A Growing Opportunity

Picture this: While you’re building your life abroad, your investment back home could be growing by 12-15% annually. That’s not just a dream – it’s the reality of India’s booming real estate market. As global markets fluctuate and traditional investment options offer modest returns, NRI real estate investment in India is emerging as a powerhouse opportunity that combines profitable returns with an emotional connection to your roots.

The numbers tell a compelling story: India’s real estate sector is on track to hit US$ 1 trillion by 2030, with the potential to contribute 13% to India’s GDP by 2025. This isn’t just another market trend – it’s a transformation that’s reshaping India’s urban landscape and creating wealth-building opportunities for NRIs worldwide.

Think about it – while you focus on your career overseas, your investment in Indian real estate could be:

- Building your retirement nest egg

- Generating steady rental income in your home currency

- Securing your future home for eventual return

- Creating a legacy for the next generation

The real estate market has shown remarkable resilience, even during global economic uncertainties. Major cities have witnessed substantial appreciation in property values, with average annual returns that outperform many international markets. This transformation has made NRI investment in India more attractive than ever before.

Did you know? According to a 2022 ANAROCK report, NRI investments in Indian real estate increased by 35% compared to the previous year

Top Reasons NRIs Are Eyeing Indian Properties

When considering NRI real estate investment in India, several unique benefits make it an attractive proposition. First and foremost, NRIs can enjoy superior returns compared to many developed markets, thanks to India’s higher growth rate and appreciation potential. The rental yield, combined with capital appreciation, often outperforms other investment options available to NRIs.

Key Financial Perks:

| Benefits | Details |

| Rental Yields | 3-4% for residential properties; 8-10% for commercial properties |

| Potential Capital Appreciation | 20-25% over 3-5 years in emerging locations |

| Tax Benefits | Under Sections 80C and 24(b) of the Income Tax Act |

| Home Loan Leverage | Interest rates starting from 8.5% |

Another significant advantage is the favorable exchange rate dynamics. When NRIs invest using foreign currency, they can benefit from the rupee’s depreciation over time, potentially amplifying their returns when viewed in their home currency. Additionally, NRI investment in India through real estate offers a tangible asset that can serve multiple purposes – a future retirement home, a vacation property, or a source of regular rental income.

The Indian government has introduced several incentives specifically for NRI investors, including tax benefits and simplified procedures for property acquisition. NRIs can avail home loans from Indian banks at competitive interest rates, making it easier to finance their investments. Furthermore, the ability to repatriate rental income and sale proceeds (subject to RBI guidelines) adds to the attractiveness of this investment avenue.

Planning Your Budget? Financial Insights for NRIs Investing in India

Before diving into NRI real estate investment in India, it’s crucial to understand the financial aspects involved. The process begins with understanding the taxation framework – both in India and the country of residence. NRIs need to be aware of TDS implications on property transactions, rental income taxation, and the impact of Double Taxation Avoidance Agreements (DTAA).

Investment costs go beyond the property price. Additional expenses include registration charges, stamp duty, maintenance costs, and property management fees. NRIs should also factor in currency exchange costs and potential fluctuations. When considering NRI investment in India, it’s essential to evaluate financing options carefully. While Indian banks offer attractive home loan schemes for NRIs, the documentation requirements and eligibility criteria differ for resident Indians.

Long-term capital gains tax implications and repatriation rules are other crucial aspects to consider. Understanding these financial nuances helps in better planning and maximizing returns. It’s advisable to consult with financial experts who specialize in NRI investments to ensure compliance and optimal tax planning.

Pro Tip: NRIs can now invest in property using their NRE/NRO accounts, making the process more streamlined and convenient.

Click, View, Buy: How Technology is Simplifying NRI Real Estate Investments

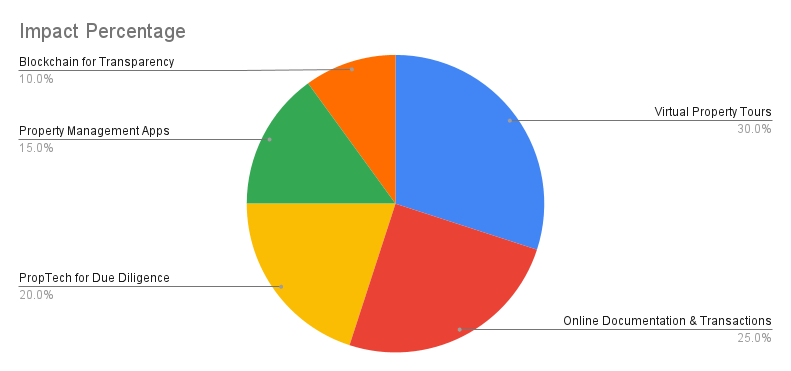

Technology has revolutionized how NRIs approach real estate investments in India. Digital platforms now enable virtual property tours, online documentation, and seamless transaction processing, making NRI real estate investment in India more accessible than ever. Property management apps and portals provide real-time updates on construction progress, rental management, and maintenance issues.

The emergence of PropTech solutions has simplified due diligence processes. NRIs can now access property registration details, litigation checks, and market analytics online. Digital payment gateways and banking interfaces have made financial transactions secure and convenient. Property management companies leverage technology to offer end-to-end services, from tenant screening to maintenance management, making it easier for NRIs to manage their investments remotely.

Additionally, blockchain technology is gradually being introduced in real estate transactions, promising enhanced transparency and security. These technological advancements have significantly reduced the challenges traditionally associated with NRI investment in India, making it possible to manage investments effectively from anywhere in the world.

Investment Hacks Every NRI Should Know for Better Returns

To maximize returns on real estate investments, NRIs should adopt a strategic approach. Location selection is crucial – areas with upcoming infrastructure projects, commercial development, or improving connectivity often offer better appreciation potential. Timing the investment right, understanding market cycles, and identifying emerging real estate hotspots can significantly impact returns.

Diversification within real estate portfolios can help optimize returns while managing risks. This could include a mix of residential and commercial properties, or investments across different cities. Regular property maintenance and timely renovations help maintain property value and attract quality tenants. Professional property management services can ensure efficient handling of day-to-day operations and better rental yields.

Understanding local market dynamics, staying updated with regulatory changes, and networking with reliable local partners are essential for successful NRI real estate investment in India. Additionally, planning exit strategies in advance and staying informed about market conditions helps in making timely investment decisions.

Did you know? Emerging satellite cities and suburbs often offer better appreciation rates compared to established metropolitan centers.

Hurdles Ahead: Common Challenges NRIs Face in Indian Real Estate

NRI real estate investment in India can be rewarding, but it comes with its share of challenges. Managing property transactions from abroad is often the biggest hurdle, with nearly 65% of NRIs citing property management as a major concern. Issues like complex documentation, unreliable property managers, tenant disputes, fluctuating currency exchange rates, and local regulatory compliance can make the process daunting. Fortunately, advancements in professional services and digital tools are making it easier for NRIs to address these challenges effectively. Here’s a breakdown of common hurdles and their solutions:

| Challenges | How to Overcome Them |

| Complex documentation requirements across states | Work with legal experts familiar with NRI property regulations and keep detailed records of all documents. |

| Finding reliable property managers | Engage property management companies specializing in NRI services. |

| Tenant-related issues | Appoint a local representative with power of attorney to handle tenant management. |

| Regulatory compliance and property taxes | Consult experienced tax advisors and utilize RERA-approved developers. |

| Currency exchange fluctuations | Partner with banks offering NRI-focused services and fixed-rate options for transactions. |

| Physical absence during transactions | Use digital platforms for virtual property tours, online payments, and document verification. |

By leveraging these strategies, NRIs can navigate the challenges of real estate investment in India with greater confidence and efficiency.

Why NRIs Shouldn’t Wait Any Longer to Invest in India

Several factors make this the perfect time for NRIs to invest in Indian real estate. Recent data shows that the Indian real estate market has grown at a CAGR of 10.5% between 2017-2022, with prime residential markets showing strong recovery post-pandemic. The sector is becoming more organized and transparent, thanks to regulatory reforms and professional management practices.

The Indian economy’s strong growth trajectory, with GDP growth projected to remain above 6% in the coming years, coupled with increasing urbanization and rising income levels, suggests sustained demand for quality real estate. Government initiatives like smart cities, infrastructure development, and improved connectivity are creating new investment opportunities.

With global economic uncertainties prevailing, Indian real estate offers a stable investment avenue with the potential for both regular income and capital appreciation. The combination of regulatory reforms, technological advancements, and market conditions makes this an ideal time for NRIs to consider real estate investments in India.

Take the First Step Towards Your Property Goals

The Indian real estate market presents a unique window of opportunity for NRIs looking to secure their financial future while maintaining strong ties with their homeland. With growing market potential, robust regulatory frameworks, and digitized processes, there’s never been a better time for NRI real estate investment in India. Take the first step today – research promising locations, connect with reputable developers, and explore properties that align with your investment goals. The path to profitable NRI investment in India starts with a single informed decision. Contact leading real estate consultants specializing in NRI investments to learn more about current opportunities in India’s thriving real estate market.

Have questions? Connect with our Investment Strategist to learn more about NRI investment in India!

OR

Don’t miss out! Connect with our Investment Strategist now and unlock the best NRI real estate opportunities in India.