K Raheja Corp Homes

K Raheja Corp Homes has been raising the standards of residential luxury in India. Over the years, the company has come to define fine lifestyles, world-class amenities, state-of-the-art architecture and unwavering quality. A Strong presence in Mumbai, Pune Hyderabad, Bengaluru and Goa backed by the company’s values of customer centricity, integrity and environmentally sustainable practices, has made K Raheja Corp Homes one of India’s leading developers of quality residences.

40 years of Legacy

K Raheja Corp is a success story spanning four decades and stands today as one of India’s leading developers. K Raheja Corp Homes is the subsidiary of the K Raheja Corp specialising in premium & luxury residential real estate.

Diversified business verticals

From exquisite residences to adaptive workplaces, skillfully created hotels and convention centers to outstanding retail destinations, the K Raheja Corp has made a significant impact on the evolution of modern-day living.

Over 200 Awards won

With its buildings certified in the categories of Gold and Platinum in IGBC, the group has been recognized with numerous prestigious awards over the years across verticals.

Eco-friendly constructions

Pioneering the industries’ responsibility towards contributing to a green society, it signed a memorandum of understanding with the CII-Green Building Council to construct green buildings, back in 2007.

Projects

Project NameRaheja Antares

Location JVLR-LBS Intersect, Mumbai

ConfigurationSuper Spacious 3 & 3 Plus BHK Apartments

Project HighlightsView

- Efficiently designed apartments with spacious balconies.

- At the intersect of JVLR and LBS Marg with all conveniences in proximity.

- Low-density living.

- Multiple lifestyle amenities spread across the ground and podium levels.

- Striking architecture by the world renowned Hafeez Contractor and stunning landscape design by Landscape Techtonix.

Enquire now

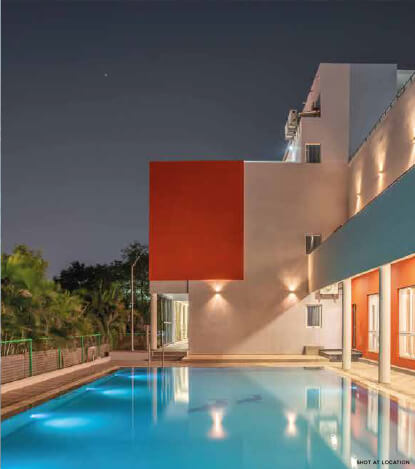

Project NameRaheja Amaltis

LocationNext to the BKC Connector, Sion

ConfigurationSpacious 3, 3.5 & 4 Bed Homes with Decks

Project HighlightsView

- Air-conditioned 3 & 4-bed homes with decks

- Located Next to the BKC Connector, Sion

- Floor-to-floor height of 3.4m (Over 11ft.)

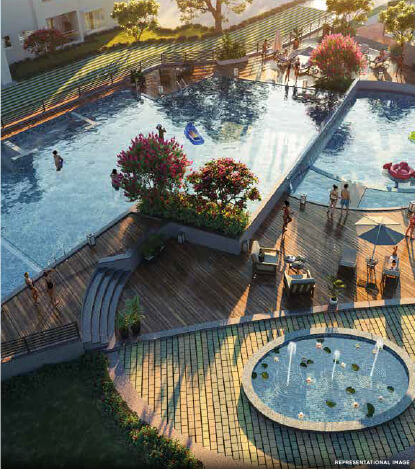

- Infinity pool and other luxurious on the rooftop

- World-class amenities spread across different levels

Enquire now

Project NameRaheja Modern Vivarea

LocationMumbai

ConfigurationUber Luxe 3, 3.5 & 4 Bed Residences

Project HighlightsView

- Two towers spread over 3 acres.

- Panoramic views of the Arabian Sea, the Golf Course and the Mahalaxmi Race Course.

- International style amenities spread across multiple levels.

- A unique skyscape experience atop the towers with dawn and dusk views

- Towering 3.8 meter floor-to-floor height

Enquire now

Project NameMaestro Juhu

LocationMumbai

ConfigurationUltra Luxe Bare Shell Residences

Project HighlightsView

- The only development in prime Juhu offering a floor plate of 10.000 sq.ft.

- Only 3 residences per floor with 4 elevators on service.

- The biggest infinity rooftop pool in Juhu measuring 25 mtrs.

- Wide decks that overlook the aerodrome greens, the cityscape or the Arabian Sea.

- Designed by renowned international architects ECO-ID (Singapore).

Enquire now

Project NameValletta Juhu

LocationMumbai

ConfigurationUltra Luxe Beachfront Mansions

Project HighlightsView

- Limited Edition Beachfront residences.

- The best vantage point for city’s best sunsets.

- Amenities spread across the ground and terrace levels.

- Located in the most luxurious Pin code of Juhu – 49.

- Minimal Column design allows for better customisation.

Enquire now

Project NameHelios

LocationOff NIBM, Pune

Configuration4 Bed Limited Residences

Project HighlightsView

- 3 Side Open spaces

- Twin Large Decks

- Centrally Air- Conditioned Homes

- Walk in Wardrobes for Every Room

- 40+ Amenities

Enquire now

Project NameRaheja Galaxy

LocationOff NIBM, Pune

Configuration2 & 3 Bedroom Residences with Mesmerizing Views

Project HighlightsView

- Breathtaking, unobstructed views from every home.

- World-class amenities spread across multiple levels.

- Residences with wide decks and walk-in wardrobes.

- Low density development with large open spaces.

- A façade inspired by the enduring elegance of timeless neoclassical design.

Enquire now

Project NameRaheja Stellar

LocationOff NIBM, Pune

Configuration3 & 4 Bed Opulent Residences

Project HighlightsView

- Grand double-height welcome lobby.

- Lavish sundecks in every apartment.

- Over 50 world class amenities.

- Contemporary styled bathrooms with marble flooring.

- 2 state-of-the-art clubhouses which is ready to use.

Enquire now

Project NameRaheja Sterling

LocationOff NIBM, Pune

Configuration2 Bed Futuristic Homes

Project HighlightsView

- 3 levels of exclusive parking area at the basement.

- 2 lavish clubhouses.

- 40+ world class unique amenities.

- Aspirational location with great connectivity.

- Spacious apartments with wide deck.

Enquire now

Project NameRaheja Viva

LocationWest Pune

ConfigurationTownhouses, Twin Villas, Independent Villas and Palatial Plots

Project HighlightsView

- Panoramic views of Sahyadri Hills

- Ready-to-use Signature Clubs

- Over 6500 trees & 60 species of birds

- Near Pune-Bengaluru Highway & Pune-Mumbai Expressway

- In proximity to Chandni chowk and Kothrud

Enquire now

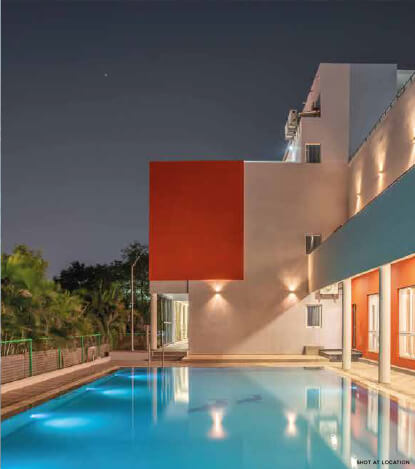

Project NameRaheja Vistas Elite

LocationHyderabad

ConfigurationSuper Spacious 2 & 3 Bed Apartments

Project HighlightsView

- Home to a warm, cosmopolitan community of 800+ families.

- Just 3.5 kms from the Habsiguda metro station.

- Homes with best views.

- A grand ready-to-use clubhouse with an array of lavish features.

- IGBC certified Vaastu compliant homes.

Enquire now

Project NameRaheja Vivarea

LocationKoramangala, Banglore

ConfigurationUltra Luxe 3, 4 & 5 BHK Apartments

Project HighlightsView

- The largest residences in Koramangala.

- Imported marble flooring in living room, bedrooms and bathrooms.

- Over 40 amenities spread across the vehicle-free central courtyard, the grand lobby and the clubhouse.

- Applied for IGBC Gold Pre-Certification.

Enquire now

Project NameRaheja Antares

Location JVLR-LBS Intersect, Mumbai

ConfigurationSuper Spacious 3 & 3 Plus BHK Apartments

Project HighlightsView

- Efficiently designed apartments with spacious balconies.

- At the intersect of JVLR and LBS Marg with all conveniences in proximity.

- Low-density living.

- Multiple lifestyle amenities spread across the ground and podium levels.

- Striking architecture by the world renowned Hafeez Contractor and stunning landscape design by Landscape Techtonix.

Enquire now

Project NameRaheja Amaltis

LocationNext to the BKC Connector, Sion

ConfigurationSpacious 3, 3.5 & 4 Bed Homes with Decks

Project HighlightsView

- Air-conditioned 3 & 4-bed homes with decks

- Located Next to the BKC Connector, Sion

- Floor-to-floor height of 3.4m (Over 11ft.)

- Infinity pool and other luxurious on the rooftop

- World-class amenities spread across different levels

Enquire now

Project NameRaheja Modern Vivarea

LocationMumbai

ConfigurationUber Luxe 3, 3.5 & 4 Bed Residences

Project HighlightsView

- Two towers spread over 3 acres.

- Panoramic views of the Arabian Sea, the Golf Course and the Mahalaxmi Race Course.

- International style amenities spread across multiple levels.

- A unique skyscape experience atop the towers with dawn and dusk views

- Towering 3.8 meter floor-to-floor height

Enquire now

Project NameMaestro Juhu

LocationMumbai

ConfigurationUltra Luxe Bare Shell Residences

Project HighlightsView

- The only development in prime Juhu offering a floor plate of 10.000 sq.ft.

- Only 3 residences per floor with 4 elevators on service.

- The biggest infinity rooftop pool in Juhu measuring 25 mtrs.

- Wide decks that overlook the aerodrome greens, the cityscape or the Arabian Sea.

- Designed by renowned international architects ECO-ID (Singapore).

Enquire now

Project NameValletta Juhu

LocationMumbai

ConfigurationUltra Luxe Beachfront Mansions

Project HighlightsView

- Limited Edition Beachfront residences.

- The best vantage point for city’s best sunsets.

- Amenities spread across the ground and terrace levels.

- Located in the most luxurious Pin code of Juhu – 49.

- Minimal Column design allows for better customisation.

Enquire now

Project NameHelios

LocationOff NIBM, Pune

Configuration4 Bed Limited Residences

Project HighlightsView

- 3 Side Open spaces

- Twin Large Decks

- Centrally Air- Conditioned Homes

- Walk in Wardrobes for Every Room

- 40+ Amenities

Enquire now

Project NameRaheja Galaxy

LocationOff NIBM, Pune

Configuration2 & 3 Bedroom Residences with Mesmerizing Views

Project HighlightsView

- Breathtaking, unobstructed views from every home.

- World-class amenities spread across multiple levels.

- Residences with wide decks and walk-in wardrobes.

- Low density development with large open spaces.

- A façade inspired by the enduring elegance of timeless neoclassical design.

Enquire now

Project NameRaheja Stellar

LocationOff NIBM, Pune

Configuration3 & 4 Bed Opulent Residences

Project HighlightsView

- Grand double-height welcome lobby.

- Lavish sundecks in every apartment.

- Over 50 world class amenities.

- Contemporary styled bathrooms with marble flooring.

- 2 state-of-the-art clubhouses which is ready to use.

Enquire now

Project NameRaheja Sterling

LocationOff NIBM, Pune

Configuration2 Bed Futuristic Homes

Project HighlightsView

- 3 levels of exclusive parking area at the basement.

- 2 lavish clubhouses.

- 40+ world class unique amenities.

- Aspirational location with great connectivity.

- Spacious apartments with wide deck.

Enquire now

Project NameRaheja Viva

LocationWest Pune

ConfigurationTownhouses, Twin Villas, Independent Villas and Palatial Plots

Project HighlightsView

- Panoramic views of Sahyadri Hills

- Ready-to-use Signature Clubs

- Over 6500 trees & 60 species of birds

- Near Pune-Bengaluru Highway & Pune-Mumbai Expressway

- In proximity to Chandni chowk and Kothrud

Enquire now

Project NameRaheja Vistas Elite

LocationHyderabad

ConfigurationSuper Spacious 2 & 3 Bed Apartments

Project HighlightsView

- Home to a warm, cosmopolitan community of 800+ families.

- Just 3.5 kms from the Habsiguda metro station.

- Homes with best views.

- A grand ready-to-use clubhouse with an array of lavish features.

- IGBC certified Vaastu compliant homes.

Enquire now

Project NameRaheja Vivarea

LocationKoramangala, Banglore

ConfigurationUltra Luxe 3, 4 & 5 BHK Apartments

Project HighlightsView

- The largest residences in Koramangala.

- Imported marble flooring in living room, bedrooms and bathrooms.

- Over 40 amenities spread across the vehicle-free central courtyard, the grand lobby and the clubhouse.

- Applied for IGBC Gold Pre-Certification.

Enquire now

FAQs

Are NRIs/POIs required to complete any formalities while purchasing residential immovable properties in India under the general permissions?

A declaration in form IP7 with the Central Office of Reserve Bank at Mumbai needs to be filed within 90 days from the date of purchase of the immovable residential property or purchase consideration’s final copy accompanied by the documents that prove the transaction and bank certificate for the paid consideration.

What documents are required for buying a property in India?

The following documents are required by NRIs while buying a property in India (non-exhaustive).

- PAN card (Permanent Account Number)

- OCI/PIO number (In case of OCI/PIO)

- Passport (For NRIs)

- Passport size photographs

- Address proof

What kind of property can an NRI or POI buy?

Agricultural land/plantation property/farmhouse usually cannot be brought by an NRI/POI in India. RBIs approval in consultation with the Government of India is required for proposals to buy such land. The only way an NRI/POI can acquire an agricultural land is through inheritance.

Can residential properties be acquired or disposed by NRIs by a way of gift?

Yes, NRIs have been granted permission by the Reserve Bank of India to acquire or dispose NRI Indian properties by way of gift to or from a relative who is an Indian citizen or a person of Indian origin (PIO) whether a resident of India or not.

Can loans be acquired by NRIs from financial institutes providing housing finance for acquisition of a house/flat for residential purpose?

Certain financial institutions like HDFC, LIC Housing Finance Ltd., etc. have been granted some general permission from the Reserve Bank and some authorized dealers have also been granted permission to lend housing loans to NRIs for the acquisition of an NRI flat/house for self-occupancy under certain conditions. The criteria like the purpose of the loan, margin money and the quantum loan will be just like the ones applicable for residential Indians. The repayment of the loan is required to be made within 15 years and not exceeding it, out of inward remittance through banking channels or out of funds in the investors’ NRE/FCNR/NRO accounts.

What is the loan sanction process and the required documentation?

NRIs are required to submit different documents than those required by the residential Indians, as they are required to submit additional documents, like the copy of their passport, of their work contract, etc. Also, NRIs have to abide by certain eligibility criteria to get home loans in India.

A vital document required for processing a home loan for an NRI is the power of attorney (POA). Since the borrower is not based in India, POA is important; the Home Finance Company would need a ‘representative’ in lieu of the NRI to deal with if needed. The POA is usually drawn on the NRIs wife/parents/children/close relatives or friends, although it not obligatory.

The documents required by NRIs to obtain home loans are bank specific. The general list is as follows:

- Passport and Visa

- The appointment letter and contract copy from the applicant’s company

- The labour card/identity card (translated in English and countersigned by the consulate), salary certificate (in English) that specifies the name, date of joining, designation and salary details, if the applicant is employed in the Middle East

- Last six months bank statements

Below is the list of documents for Salaried and Self-Employed NRI applicants. There may be additional specific requirements by the bank.

Salaried NRI Applicants:

- Copy of valid passport and visa showcasing stamps

- Copy of a valid visa/work permit and equivalent documents supporting the NRI status

- Statement from overseas bank account showing the last 3 months salary credits

- Latest contract copy for the evidence of salary/salary certificate/wage slips

Self-Employed NRI Applicants:

- Copy of valid passport and visa showcasing stamps

- A brief business profile of the applicant’s/Trade license or an equivalent document

- The last 6 months statements of the overseas bank account and NRE/NRO account

- Computation of income, P&L account and B/Sheet for last 3 years certified by the C.A. / CPA or any other relevant authority as the case may be (or equivalent company accounts)

For the NRI/PIO/OCI what is the tax treatment on the income generated on selling or renting the property?

Income tax is not applicable to the mere acquisition of the property. However, any sort of income generated from the purchase of that property, in the form of rent or annual value of the house, if the residential property is only owned by that person in India, and/or short or long term capital gains arising on the sale of this house or part is therefore taxable in the hands of the owner.

Is Capital Gains Tax (CGP) applicable for NRI/PIO/OCI?

Yes, the long-term and short-term gain is applicable in the hands of the non-resident.

How does the Double Tax Avoidance Agreement (DTAA) work for NRIs?

In most countries, the Double Tax Avoidance Agreement (DTAA) on the capital gain from the sale of immovable property will be taxed in the country where the immovable property is located. So, when an NRI owns immovable property in India, that person is liable to pay the tax that is generated on the capital gained on the sale of that property. Similarly, under most tax treaties letting of immovable property in India would be taxed in India.

EMI Calculator

**Note: For exceeding 120 no. of payments, a group of 12 payments will be combined into a single payment number for better chart visibility.

| Period | Payment | Interest | Balance |

|---|